Advanced Accounting: A Comprehensive Guide (PDF Focus)

Advanced accounting PDFs offer a robust learning experience, mirroring the critical thinking demanded by the CPA exam and future professional accounting roles, as exemplified by Hoyle, Schaefer, and Doupnik’s methods․

What is Advanced Accounting?

Advanced accounting delves beyond the fundamentals, focusing on complex financial reporting issues not fully covered in introductory courses․ It’s a specialized field examining topics like business combinations, consolidated financial statements, and intricate aspects of equity accounting – all frequently encountered in professional practice․

PDF resources play a crucial role in mastering these concepts․ They provide detailed explanations, illustrative examples, and practice problems essential for comprehension․ The approach championed by authors like Hoyle, Schaefer, and Doupnik, often available in PDF format, emphasizes critical thinking․ This isn’t merely memorization, but understanding the why behind accounting rules․

These PDFs often mirror the challenges faced during CPA exam preparation and real-world accounting scenarios․ They equip students with the analytical skills needed to navigate complex financial landscapes, making them invaluable tools for aspiring and practicing accountants alike․ They are a cornerstone of advanced learning․

Why Study Advanced Accounting?

Advanced accounting is vital for aspiring CPAs and professionals seeking roles demanding sophisticated financial analysis․ It equips you to handle complex transactions – mergers, acquisitions, international operations – that introductory courses only touch upon․ Mastery unlocks opportunities in corporate accounting, auditing, and financial consulting․

PDF study materials, particularly those aligned with approaches like Hoyle, Schaefer, and Doupnik, are instrumental in this journey․ They foster the critical thinking skills essential not just for exams, but for a successful accounting career․ These PDFs prepare you to analyze financial statements with nuance and make informed decisions․

Furthermore, understanding advanced concepts allows you to interpret and apply evolving accounting standards effectively․ Access to comprehensive PDF resources ensures you stay current, a necessity in this dynamic field․ It’s an investment in your professional future, providing a competitive edge․

The Role of PDF Resources in Advanced Accounting

PDF resources are central to mastering advanced accounting, offering a portable and accessible learning format․ They allow for focused study, annotation, and easy reference to complex topics like business combinations and consolidated financial statements․ The structured nature of PDFs, especially those mirroring established textbooks like Hoyle, Schaefer, and Doupnik, reinforces understanding․

These PDFs often include practice problems and solutions, crucial for exam preparation․ They facilitate self-paced learning, allowing students to revisit challenging concepts as needed․ Furthermore, PDFs enable offline access, eliminating reliance on internet connectivity․

The ability to search within PDF documents quickly locates specific information, saving valuable study time․ Utilizing PDFs effectively, alongside other resources, is key to developing the critical thinking skills demanded by the CPA exam and a successful accounting career․

Core Concepts in Advanced Accounting

Advanced accounting PDFs expertly cover vital areas like business combinations, consolidations, foreign currency translation, and intricate intercompany transaction analyses for comprehensive understanding․

Business Combinations

Advanced accounting PDFs dedicate significant attention to business combinations, a complex area involving the acquisition of one company by another․ These resources thoroughly explain the accounting treatment for purchase accounting, including identifying the acquirer, determining the acquisition date fair value, and allocating the purchase price to the acquired assets and liabilities․

Key concepts covered within these PDFs include goodwill calculation, bargain purchase gains, and the accounting for contingent consideration․ Students will find detailed examples illustrating the consolidation process post-acquisition, focusing on how the acquirer’s financial statements reflect the combined entity․ Furthermore, these materials often delve into the nuances of different acquisition structures and their impact on financial reporting․

Understanding business combinations is crucial, and well-structured PDFs provide the necessary foundation for tackling complex scenarios encountered in professional practice and on the CPA exam․

Consolidated Financial Statements

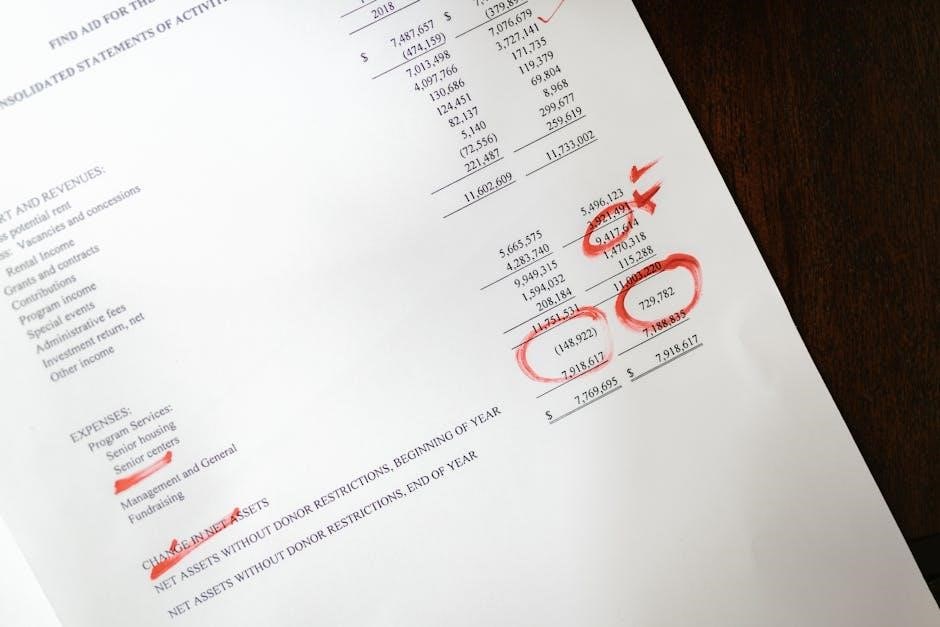

Advanced accounting PDFs extensively cover consolidated financial statements, a cornerstone of understanding group accounting․ These resources detail the process of combining the financial statements of a parent company and its subsidiaries as if they were a single economic entity․ Emphasis is placed on eliminating intercompany transactions and balances to present a true and fair view of the group’s financial position and performance․

PDF materials typically provide step-by-step guidance on preparing the consolidation worksheet, addressing complexities like non-controlling interests (NCI), and accounting for different reporting dates․ Students will encounter detailed examples illustrating the consolidation of various ownership structures and the impact of different accounting policies․

Mastering consolidated statements is vital, and comprehensive PDFs offer the necessary tools and practice to navigate this challenging area, preparing students for professional application and CPA exam success․

Foreign Currency Translation

Advanced accounting PDFs dedicate significant attention to foreign currency translation, a critical skill in today’s globalized economy․ These resources explain the intricacies of converting financial statements denominated in foreign currencies into a reporting currency, adhering to standards like ASC 830․ They detail the current rate method and the temporal method, outlining when each is appropriate․

PDF materials provide practical guidance on identifying functional currencies, calculating exchange rates, and recognizing translation adjustments․ Students will find detailed examples illustrating the impact of fluctuating exchange rates on a company’s financial performance and position․

Understanding these concepts is crucial for accurate financial reporting, and well-structured PDFs offer the necessary framework and practice to confidently tackle foreign currency translation challenges, preparing students for real-world scenarios and the CPA exam․

Intercompany Transactions

Advanced accounting PDFs thoroughly cover intercompany transactions, a complex area arising when a parent company and its subsidiaries conduct business with each other․ These resources explain how to eliminate the effects of these transactions during consolidation to present a true and fair view of the consolidated financial statements․

PDF materials detail the elimination of intercompany profits on assets, inventory, and receivables, ensuring that consolidated figures aren’t artificially inflated․ They also address intercompany debt and equity transactions, outlining the necessary adjustments to avoid double-counting․

Students benefit from detailed examples illustrating the step-by-step process of eliminating intercompany items, enhancing their understanding of consolidation principles․ Mastering this topic, facilitated by comprehensive PDFs, is vital for accurate consolidated reporting and success on the CPA exam․

Advanced Topics & Techniques

Advanced accounting PDFs delve into specialized areas like governmental and not-for-profit accounting, alongside complex partnership methods and crucial tax accounting considerations․

Partnership Accounting – Advanced Methods

Advanced accounting PDFs dedicated to partnership accounting move beyond basic allocations of profit and loss․ They comprehensively cover complex topics such as partner admissions and withdrawals, including the impact on goodwill and capital accounts․ These resources detail the intricacies of different partnership structures – general, limited, and limited liability partnerships – and their unique accounting treatments․

Furthermore, advanced PDFs explore the nuances of partnership liquidations, outlining the methods for distributing assets and settling liabilities․ They provide detailed examples illustrating the order of distribution and the potential for losses to partners․ A key focus is on the tax implications of partnership operations, including the allocation of taxable income and the reporting requirements for partners․ Understanding these advanced methods, often presented clearly within these PDFs, is crucial for accurate financial reporting and informed decision-making within partnership structures․

Governmental Accounting

Advanced accounting PDFs specializing in governmental accounting diverge significantly from for-profit entity standards․ They delve into fund accounting, a core principle where resources are categorized based on restrictions and purposes – general, special revenue, capital projects, and fiduciary funds․ These PDF resources meticulously explain the modified accrual basis of accounting, contrasting it with the standard accrual method․

Detailed coverage includes the complexities of budgetary accounting, encompassing budget preparation, encumbrances, and budgetary control․ Advanced PDFs also address the unique reporting requirements for governmental entities, including the Comprehensive Annual Financial Report (CAFR)․ They explain the presentation of governmental fund financial statements and the government-wide financial statements․ Understanding these specialized concepts, readily available in comprehensive PDF guides, is vital for accountants working within the public sector and ensuring transparency and accountability․

Not-for-Profit Accounting

Advanced accounting PDFs dedicated to not-for-profit organizations highlight unique financial reporting standards․ These resources emphasize the importance of net asset classification – unrestricted, temporarily restricted, and permanently restricted – crucial for understanding donor intent and resource allocation․ They thoroughly explain revenue recognition, particularly contributions, grants, and exchange transactions, often differing from for-profit accounting․

PDF guides detail the Statement of Functional Expenses, a key report showcasing program services versus supporting services․ Understanding these classifications is vital for demonstrating organizational efficiency․ Furthermore, these materials cover topics like voluntary health and welfare organizations, colleges and universities, and hospitals, each with specific accounting nuances․ Accessing comprehensive PDF materials provides a solid foundation for navigating the complexities of not-for-profit financial management and ensuring compliance with relevant regulations․

Tax Accounting Considerations

Advanced accounting PDFs focusing on tax implications bridge the gap between financial reporting and tax law․ These resources delve into temporary and permanent differences between book and taxable income, crucial for calculating deferred tax assets and liabilities․ They explain the complexities of income tax allocation in consolidated groups, a significant aspect of corporate tax planning․

PDF materials often cover topics like partnerships and S corporations, detailing the unique tax rules governing these entities․ Understanding tax credits, deductions, and exemptions is thoroughly addressed․ Furthermore, these guides explore the impact of recent tax legislation changes, ensuring students and professionals stay current․ Utilizing comprehensive PDF resources is essential for mastering the intricacies of tax accounting and minimizing tax liabilities, offering a practical application of advanced accounting principles․

Utilizing Advanced Accounting PDFs Effectively

Advanced accounting PDFs become powerful study tools when paired with annotation, conversion, and community engagement, ensuring comprehensive understanding and exam success․

Finding Reliable PDF Sources

Locating trustworthy advanced accounting PDFs requires a discerning approach․ University websites often host course materials, including lecture notes and past exams, offering valuable, albeit potentially dated, resources․ Reputable accounting publishers, like those associated with Hoyle, Schaefer, and Doupnik, frequently provide sample chapters or supplementary materials in PDF format․

However, caution is paramount․ Avoid websites offering suspiciously free or pirated content, as these may contain errors or outdated information; Professional accounting organizations, such as the AICPA, sometimes release white papers or guides as PDFs․ Online libraries and academic databases, accessible through university affiliations, are excellent sources for peer-reviewed articles and research papers relevant to advanced accounting topics․ Always verify the author’s credentials and the publication date to ensure the PDF’s reliability and relevance to current accounting standards․

Evaluating the Quality of PDF Materials

Assessing the quality of advanced accounting PDFs is crucial for effective learning․ Begin by examining the author’s credentials and affiliations – are they recognized experts in the field? Check the publication date; accounting standards evolve, so recent materials are preferable․ Scrutinize the content for clarity, accuracy, and consistency with established accounting principles․

Look for comprehensive explanations, illustrative examples, and practice problems․ A high-quality PDF will align with the approaches of respected authors like Hoyle, Schaefer, and Doupnik, fostering critical thinking․ Beware of PDFs with numerous errors, ambiguous language, or a lack of supporting documentation․ Cross-reference information with other reliable sources, such as textbooks or professional accounting websites, to verify its accuracy․ A well-structured and logically presented PDF is a strong indicator of its overall quality․

Hoyle, Schaefer, and Doupnik’s Approach (PDF Integration)

Integrating PDFs aligned with Hoyle, Schaefer, and Doupnik’s advanced accounting methodology provides a significant advantage․ Their approach emphasizes critical thinking, mirroring the demands of the CPA exam and real-world accounting practice․ PDFs based on their work often include detailed examples and challenging problems designed to develop analytical skills․

These resources typically focus on a conceptual understanding of accounting principles, rather than rote memorization․ Look for PDFs that incorporate their signature style – clear explanations, practical applications, and a focus on professional judgment․ Utilizing these materials effectively requires active engagement, including working through examples and attempting practice questions․ The goal is to cultivate the ability to apply accounting knowledge to complex scenarios, preparing students for success in their careers․

Using PDFs for Exam Preparation (CPA Focus)

Advanced accounting PDFs are invaluable tools for CPA exam preparation, particularly those mirroring the rigorous standards of Hoyle, Schaefer, and Doupnik․ These resources offer concentrated practice with complex accounting scenarios, crucial for mastering the exam’s challenging questions․ Focus on PDFs containing simulated exam questions and detailed answer explanations․

Effective preparation involves actively working through these PDFs, identifying weak areas, and revisiting core concepts; Utilize the PDFs to build stamina for the exam’s length and format․ Prioritize materials that emphasize critical thinking and application of principles, as the CPA exam tests beyond simple recall․ Supplement PDF study with official CPA review courses, but leverage PDFs for targeted practice and reinforcement of key concepts․ Consistent, focused study with quality PDFs significantly increases your chances of success․

Specific Areas Covered in Advanced Accounting PDFs

Advanced accounting PDFs comprehensively cover equity method accounting, push-down accounting, segment reporting, and complex Earnings Per Share (EPS) calculations, vital for professional expertise․

Equity Method Accounting

Equity method accounting, extensively detailed within advanced accounting PDFs, is crucial when one company significantly influences another, but doesn’t exert complete control․ These resources thoroughly explain how to account for investments where influence, typically indicated by 20-50% ownership, exists․

PDFs demonstrate the initial investment recording, subsequent adjustments for the investor’s share of the investee’s profits or losses, and dividend income․ They clarify the complexities of upward stream and downstream transactions between the investor and investee, ensuring accurate consolidated financial reporting․

Furthermore, advanced accounting PDFs often include illustrative examples and practice problems, solidifying understanding of journal entries, balance sheet presentations, and income statement impacts․ Mastering this method is essential for comprehending consolidated financial statements and preparing for advanced accounting certifications like the CPA exam․

Push-Down Accounting

Push-down accounting, a less common but vital topic covered in detailed advanced accounting PDFs, arises during acquisitions where the acquiring company is a subsidiary․ Instead of reflecting the acquisition on the parent company’s books, the acquiree’s financial statements are “pushed down” to reflect the acquisition as if it occurred directly at the acquiree level․

PDF resources meticulously explain how to adjust the acquiree’s historical cost basis of assets and liabilities to fair value, as if the acquisition had always been part of its history․ This method requires careful consideration of goodwill and other acquisition-related adjustments․

Advanced accounting PDFs provide step-by-step guidance on applying push-down accounting, including journal entries and the impact on the acquiree’s financial statements․ Understanding this technique is crucial for accurately representing acquisitions within a consolidated group structure and for CPA exam preparation․

Segment Reporting

Segment reporting, thoroughly detailed in advanced accounting PDFs, is a crucial aspect of consolidated financial statement presentation․ It requires companies to disclose financial information about their operating segments – distinct components of a business earning revenues and incurring expenses – if those segments meet certain quantitative thresholds․

PDF materials explain the identification of reportable segments based on the “management approach,” focusing on how management assesses performance and allocates resources․ These resources detail the disclosure requirements, including revenue, profit or loss, and segment assets, allowing investors to evaluate performance across different parts of the business․

Advanced accounting PDFs provide practical examples and illustrations of segment reporting, including how to apply the aggregation criteria and the impact on consolidated financial statements․ Mastering this topic is essential for understanding a company’s overall performance and for success on the CPA exam․

Earnings Per Share (EPS) – Complex Calculations

Advanced accounting PDFs dedicate significant attention to Earnings Per Share (EPS), particularly its complex calculations․ Basic EPS is straightforward, but diluted EPS, covered extensively in these resources, involves potentially dilutive securities like stock options, warrants, and convertible debt․

PDF materials meticulously explain how to calculate the dilutive effect of these securities, requiring careful consideration of their exercise price and potential impact on net income and weighted-average shares outstanding․ These resources often include detailed examples demonstrating the treasury stock method and the if-converted method․

Understanding these calculations is vital, as EPS is a key metric for investors․ Advanced accounting PDFs provide the necessary framework for mastering these concepts, preparing students for the intricacies of the CPA exam and real-world financial analysis․

Tools & Resources for PDF Study

Advanced accounting PDFs benefit from annotation tools, text conversion software, and online communities, enhancing comprehension and facilitating efficient study for accounting professionals․

PDF Annotation Tools

Utilizing PDF annotation tools is crucial when studying advanced accounting PDFs․ These tools transform static documents into interactive learning resources․ Highlighting key concepts, such as consolidation adjustments or foreign currency translation methods, allows for quick review and reinforces understanding․

Adding sticky notes provides space for personalized explanations and reminders of complex rules, like those governing business combinations․ Drawing tools can visually represent consolidated entity structures or intercompany transaction flows․

Popular options include Adobe Acrobat Pro, PDF Expert, and Xodo․ Many offer features like text commenting, allowing you to pose questions directly within the PDF․ The ability to search annotations is invaluable during exam preparation, quickly locating specific concepts․ Effectively leveraging these tools maximizes the value of your advanced accounting PDF study materials, mirroring the analytical skills needed for the CPA exam and professional practice․

PDF to Text Conversion

Converting advanced accounting PDFs to text format can unlock additional study methods, though it requires careful consideration․ While PDFs preserve formatting, text conversion allows for keyword searching across the entire document – invaluable when researching specific accounting standards or examples․

However, complex formatting, like tables detailing consolidated financial statements or intricate EPS calculations, can be lost during conversion․ This can hinder understanding of the material’s original presentation․

Tools like Adobe Acrobat, online converters, and even Microsoft Word offer PDF to text functionality․ After conversion, meticulously review the text for errors or formatting inconsistencies․ This process is most beneficial when focusing on conceptual understanding rather than precise numerical layouts․ Remember, the goal is to supplement, not replace, studying the original advanced accounting PDF․

Online Advanced Accounting Communities

Advanced accounting PDFs are greatly enhanced by participation in online communities․ Forums, LinkedIn groups, and dedicated subreddits provide platforms to discuss complex topics like business combinations, foreign currency translation, and governmental accounting․ Sharing insights and questions regarding advanced accounting PDF materials can clarify challenging concepts․

These communities often feature discussions on specific textbooks, including those by Hoyle, Schaefer, and Doupnik, allowing students to collaborate on problem sets and exam preparation․

Furthermore, members frequently share links to supplementary resources, including updated accounting standards and relevant articles․ Active engagement fosters a deeper understanding and provides diverse perspectives․ Remember to critically evaluate information shared and verify it against authoritative sources when studying from advanced accounting PDFs․

Staying Updated with Accounting Standards (PDF Updates)

Advanced accounting PDFs quickly become outdated as accounting standards evolve․ Regularly seeking updates is crucial, and many professional organizations offer downloadable PDF summaries of new pronouncements․ These updates often detail changes impacting areas like consolidated financial statements, earnings per share calculations, and intercompany transactions․

Subscribing to email alerts from bodies like the FASB and IASB ensures timely notification of revisions․ When utilizing advanced accounting PDF textbooks, cross-reference the content with the latest standards․

Resources from Hoyle, Schaefer, and Doupnik frequently incorporate updates, but verifying against official sources remains essential․ Staying current is vital for both academic success and professional practice, ensuring your understanding aligns with current regulations when working with advanced accounting PDFs․